The Nationalization of Banks in Mexico

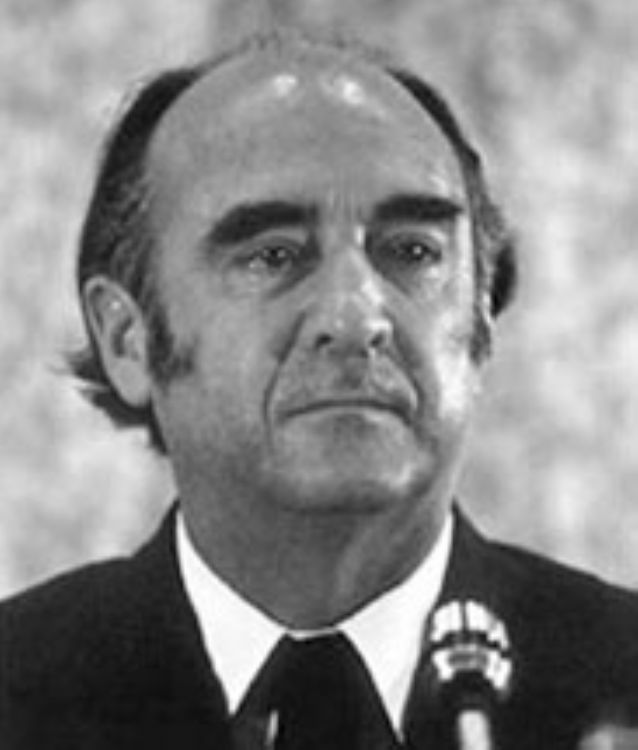

During his last state of the union address, José Lopez Portillo, President of Mexico from 1976 to 1982, decreed the nationalization of banks as a measure to stop the flight of capital, which had then surpassed 30,000 million dollars. In this same speech, he also made the banks responsible of promoting the flight of capital and criticized the âdollar takersâ.

The nationalization of 49 Mexican banks was a decision labeled as desperate who outcome forced the delivery of banks to foreign capital during the 1990âs and two decades of economic stagnancy.

This era had enjoyed an oil peak with the exploitation of the Cantarell deposits, promoting an average growth of 7% GDP per year.

Unfortunately, politicians thought these oil deposits were unlimited and squandered public finances, causing a 17% GDP deficit and tripling foreign debt to more than 60,000 dollars, triggering inflation and devaluation.

The good levels of technological development achieved during the 1970âs had disappeared only ten years later, when Mexicoâs banks were outdated and weak.

Bankers refrained from protesting after receiving Bank Indemnity Bonds totaling 1,200 million dollars, plus interests, which continued being paid until 1989.

Mexican banks became privatized again during the administration of Carlos Salinas de Gortari (1988-1994), who sold them to stock brokers. Used to speculative investment, took the banks to bankruptcy in order to sell them to foreign banks.

Currently, 92% of Mexicoâs banks belong to foreign financial groups.

Artículo Producido por el Equipo Editorial Explorando México.

Copyright Explorando México, Todos los Derechos Reservados.